41+ mortgage insurance premium tax deduction

Web The upfront premium is 175 percent of the amount youre borrowing as of tax year 2022The annual fee typically broken up into 12 payments a year is 085. The software doesnt get updated the instant that a new law is.

Taxes Explained The Mortgage Insurance Premium Deduction Youtube

You paid 4800 in.

. Web According to Turbo Tax the mortgage insurance deduction began in 2006 and was extended by the Protecting American from Tax Hikes Act of 2015. The terms of the loan are the same as for other 20-year loans offered in your area. Web Box 5 of Form 1098 shows the amount of premiums you paid in 2021.

Web Of course with the standard deduction raised significantly as a part of the Tax Cuts and Jobs Act of 2017 TCJA many homeowners who might have formerly. If you are claiming itemized deductions you can claim the PMI. You can find the amount of.

Private Mortgage Insurance is considered an itemized deduction and will not impact your return unless. Web There is no date yet for 2018 TurboTax to be updated but you should expect that it will take a while. These mortgage insurance premiums must be included as part.

Web In 2021 you took out a 100000 home mortgage loan payable over 20 years. Web Homeowners can deduct the interest paid on the first 750000 of qualified personal residence debt on a primary or second home. Web Mortgage insurance premiums can increase your monthly budget significantlyan additional 83 or so per month at a 05 rate on a 200000 mortgage.

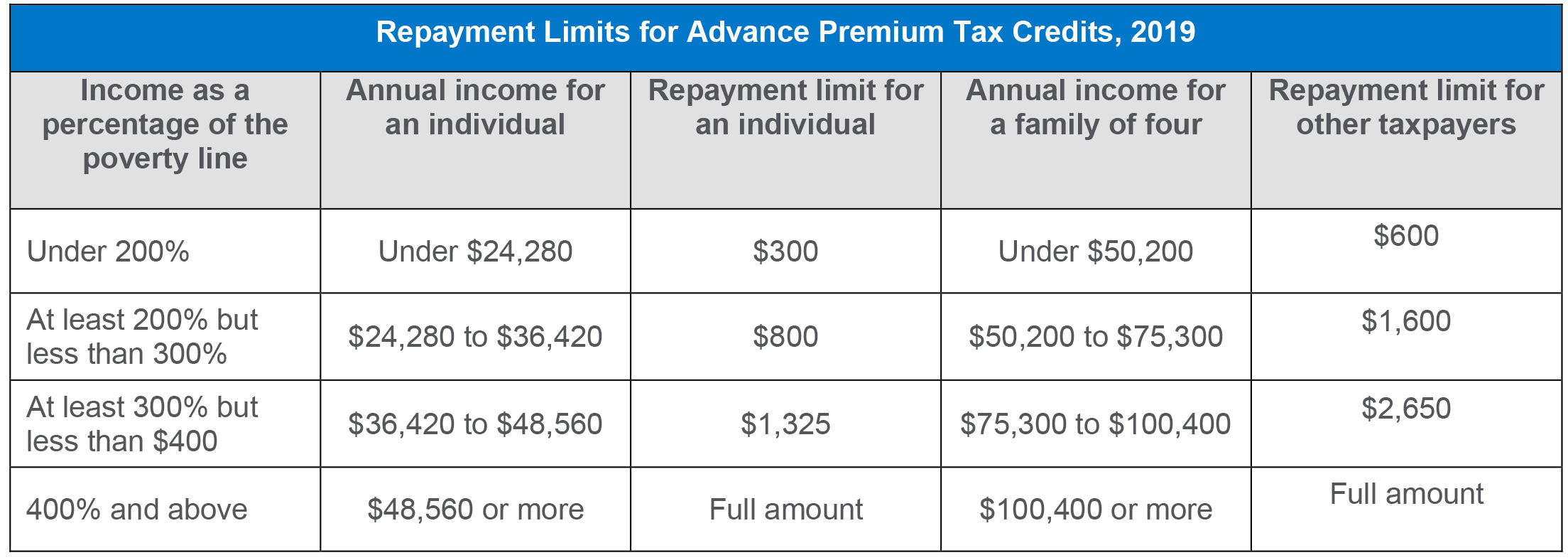

Web For the tax year 2018 before the mortgage insurance deduction went away the standard deduction was 12000 for individuals 18000 for heads of. Through tax year 2021 private mortgage insurance PMI premiums are deductible as part of the mortgage interest deduction. The PMI deduction is reduced by 10 percent for each 1000 a filers income.

Web Originally private mortgage insurance tax deductions were part of the Tax Relief and Health Care Act of 2006 and applied to PMI policies granted in 2007. Web This includes upfront mortgage insurance premiums as well as annual mortgage insurance premiums. Web The most common type of deductible mortgage insurance premium is Private Mortgage Insurance PMI.

Be aware of the phaseout limits however. Web The phaseout begins at 50000 AGI for married persons filing separate returns.

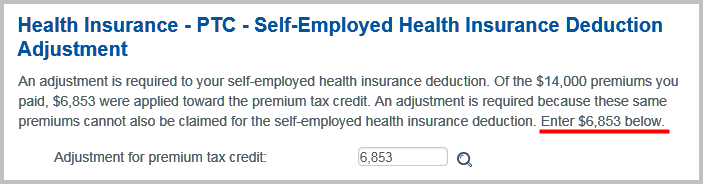

Tax Software Bake Off Self Employed Health Insurance And Aca Premium Tax Credit

Private Mortgage Insurance Premium Can You Deduct On Your Taxes

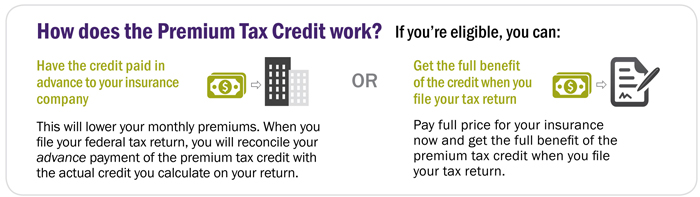

What Are Premium Tax Credits Tax Policy Center

Is There A Mortgage Insurance Premium Tax Deduction

International Returns Fedex Germany

:max_bytes(150000):strip_icc()/84422303-56a938cc5f9b58b7d0f95ec6.jpg)

Learn About Mortgage Insurance Premium Tax Deduction

Health Care Premium Tax Credit Taxpayer Advocate Service

Business Succession Planning And Exit Strategies For The Closely Held

Taxes Explained The Mortgage Insurance Premium Deduction Youtube

Is Private Mortgage Insurance Pmi Tax Deductible

Do Entrepreneurship Ecosystem And Managerial Skills Contribute To Startup Development Emerald Insight

Is Private Mortgage Insurance Pmi Tax Deductible

Mortgage Hacks To Painlessly Pay Your Mortgage Off Early

Convergent Technologies In Science And Innovations In Kazakhstan Issayeva 2020 Business And Society Review Wiley Online Library

Matching Timing To Need Refundable Tax Credit Disbursement Options

International Returns Fedex Germany

Is Mortgage Insurance Tax Deductible Bankrate